June 2025

1 Year of the HVP Risk Dashboard

1 year ago we launched HVP Risk Dashboard to provide our clients and the investing public with our broad thoughts on markets and to share updated views in between our quarterly investor letters. Along the way we’ve shared charts, graphs, stats, video interviews, a podcast, our 10 Surprises, and Field Notes from trips to investor events for some of the firm’s holdings. We are grateful to each of our readers and we hope you enjoy the updates! After two special editions where amidst the tariff induced selloff in April we used a video interview our Christopher P. Davis did to have a “Risk Dashboard in Action” and May’s momentous Field Notes for Berkshire-Hathaway & Markel , we return to our usual chartbook and commentary format. The times, however, remain anything but normal.

We write with just over 2 weeks before the end of the 90 day pause on the Trump administration’s reciprocal tariffs is set to expire. The details on any finalized trade deals between the US and counterparties have yet to emerge. In April, before this 90 day pause, equity markets moved swiftly to price a “worst-case” outcome for global trade and the US economy. Since that pause was put in place, markets have begun to price what feels like a “best-case” outcome - a permanent pause on anything that matters. Invariably, reality will fall somewhere between the worst and best cases, which has led us to temper our enthusiasm for this rally on tariff grounds. On the matter of the budget deficit and federal debt, we are actually a bit more optimistic than in the past. While the mechanics of it are too involved for this short note, we see a scenario in which the path of US Treasury debt refunding and debt issuance, coupled with at least arms-length central bank coordination, could lead to lower rates, lower debt expense, and an improved path. There are a few different decision trees that can get you there, but a few of the paths do end up with something that is long-term bullish for assets, especially those that can grow their cash flows over time. If some of those early steps continue to progress, the market may quickly sniff them out. But that’s a long term matter.

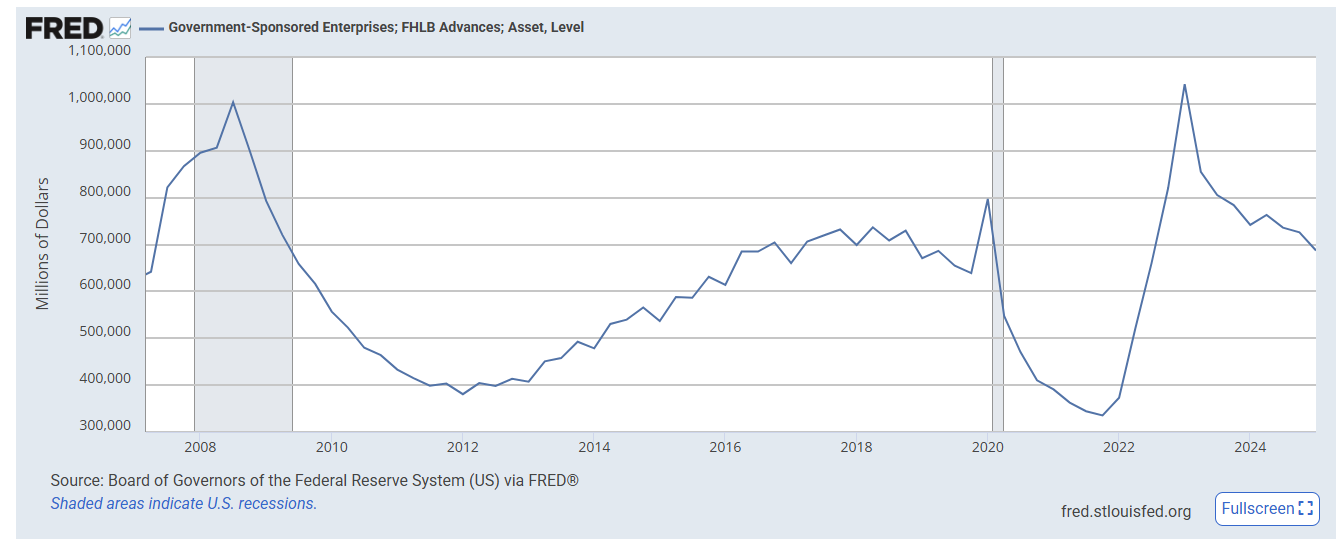

In the short term, we expect heightened volatility for the rest of the summer. Between now and July 9th, there are a scant 13 US trading days due to the Juneteenth and July 4th holidays. Throw in many risk takers taking time off and markets can easily get jumpy. That all was the case before the simmering conflict between Israel and Iran & its proxies boiled over on the evening of June 12th. Markets had largely shrugged off the tensions in the Middle East since the October 7, 2023 Hamas attacks on Gaza. At this point, it is only fair to consider it an active war zone with nuclear ramifications. As investors, we do not see too many immediate off-ramps, which means this risk will be with us for awhile.

One of the best advantages an investor can have is time. We are fortunate at HVP to have a loyal and patient investor base which gives us the freedom to treat short-term disruptions as long term opportunities. The next few weeks look to be incredibly headline driven.

Themes to Takeaway

Bullish Themes

IPOs have performed well in early trading and SPAC issuance has stepped up significantly - both point to “risk-on” investor sentiment.

Inflation in government statistics has not (yet) moved higher due to trade policies. It is still a stretch to call the labor market weak.

Q1 Earnings Results were strong throughout most sectors, notably technology and AI related firms. The massive amount of AI investment by corporations appears to be undeterred by recent events.

Bearish Themes

The suspended animation of the tariff pause is nearly over without major deals signed.

There is open conflict between middle-eastern nations.

The “Big-Beautiful Bill” is yet to be passed and has debatable impacts on the long term budget deficit.

Keep your eye on

Do a flurry of trade deals emerge?

Does an off-ramp for the Israeli/Iranian war appear?

Whatever happened to?

Living within your means?

If you haven’t already….

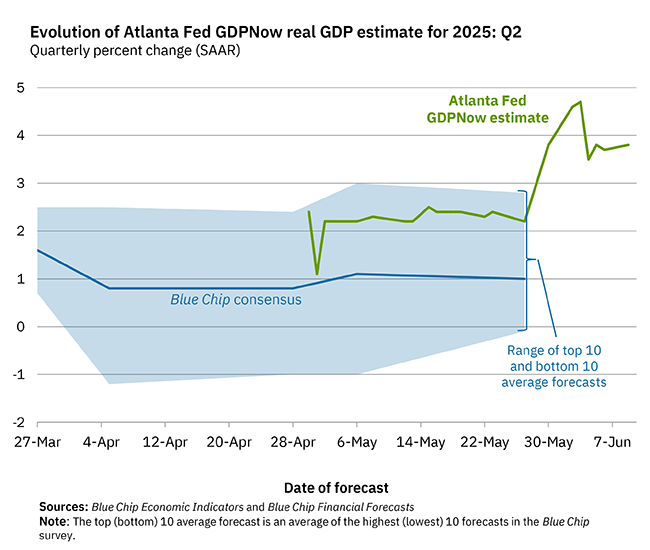

Lies, Damn Lies, and Economic Statistics

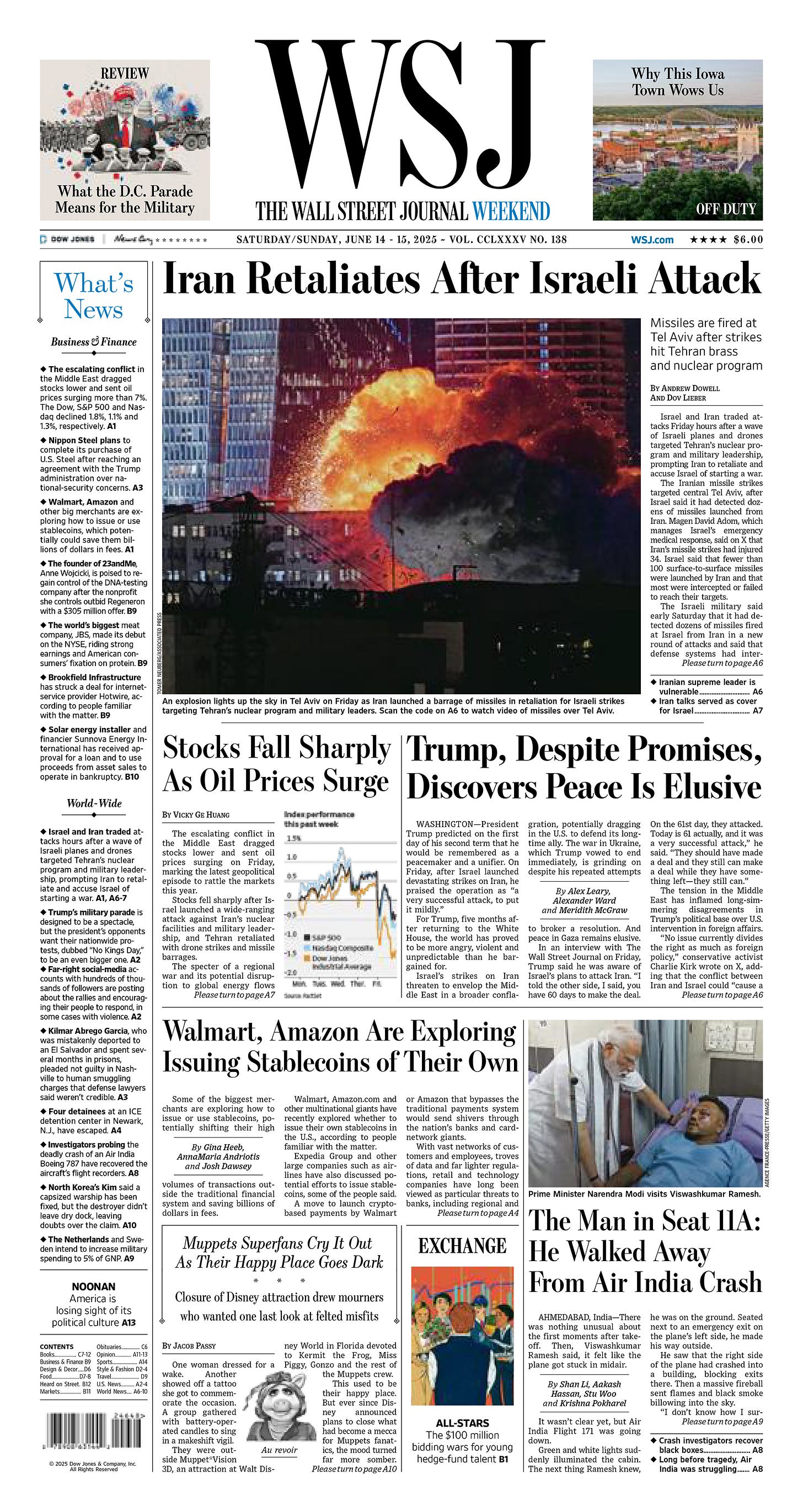

Atlanta Fed GDPNOW!

Y= C + I + G + Xn

June 9, 2025 Estimate: +3.8% for Q2

Alternative Looks at the Labor Force:

U6 Unemployment calculated in the pre-1994 adjustment method:

27.50%

(John Williams’ Shadow Government Statistics April 2025)

Tech Sector Layoffs:

2025: 62,832 employees /141 companies

2024: 152,074 employees/546 companies

2023: 263,180 employees/1,191 companies

2022: 166,269 employees/1,064 companies

Federal Sector Departures & “DOGE” Cuts:

Total YTD Federal Departures: 171,843

…of which DOGE Layoffs are: 61,296

(layoffs.fyi as of 6/14/2025)

Global Central Bank Postures

The Movement of the US Treasury Yield Curve

Blue = Current; Red = 6 months ago; Yellow =1 Year Ago

Net % of Banks Tightening Lending Standards for C&I Loans

Looking at Housing

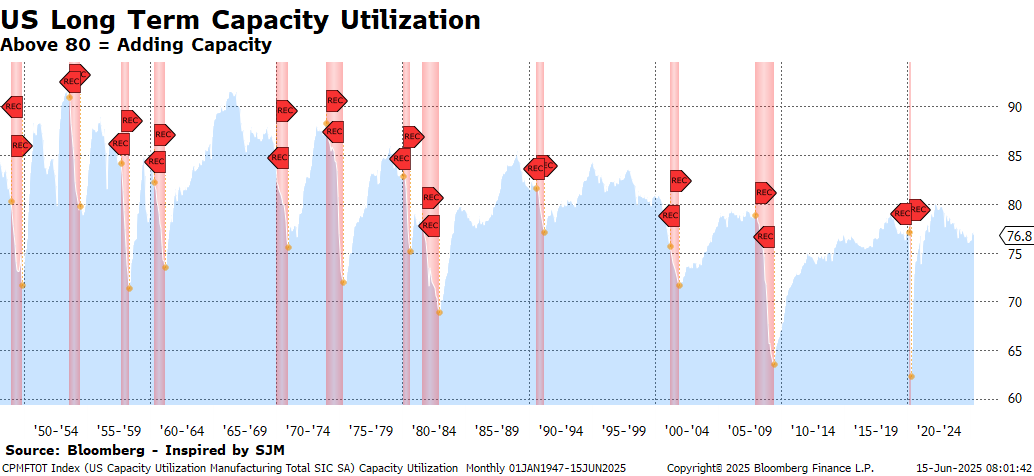

Canary in the Coal Mine: FHLB Borrowings

Performance of Gold in Major Currencies - % Change

Broad Market Levels

Top Panel/Blue = SPY; Middle Panel/Green = HYG; Bottom Panel/Red = CMBS. As of close on 6/13/2025.

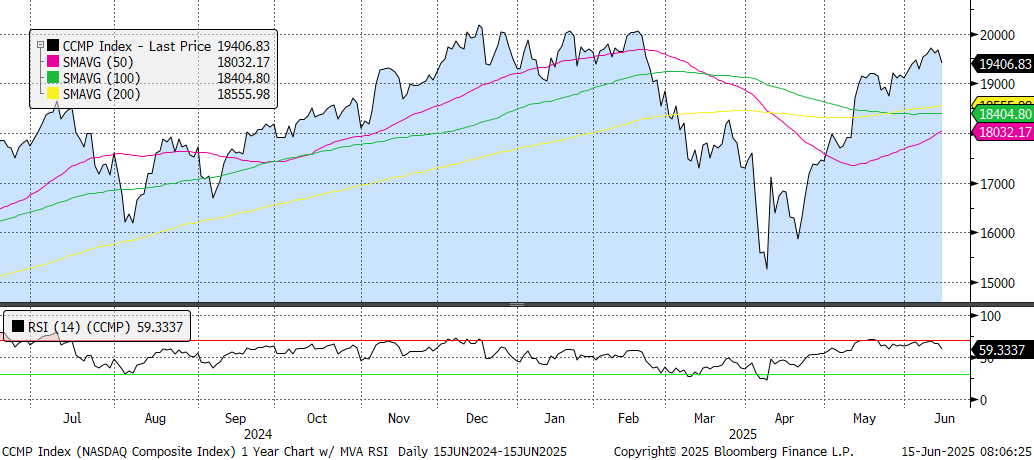

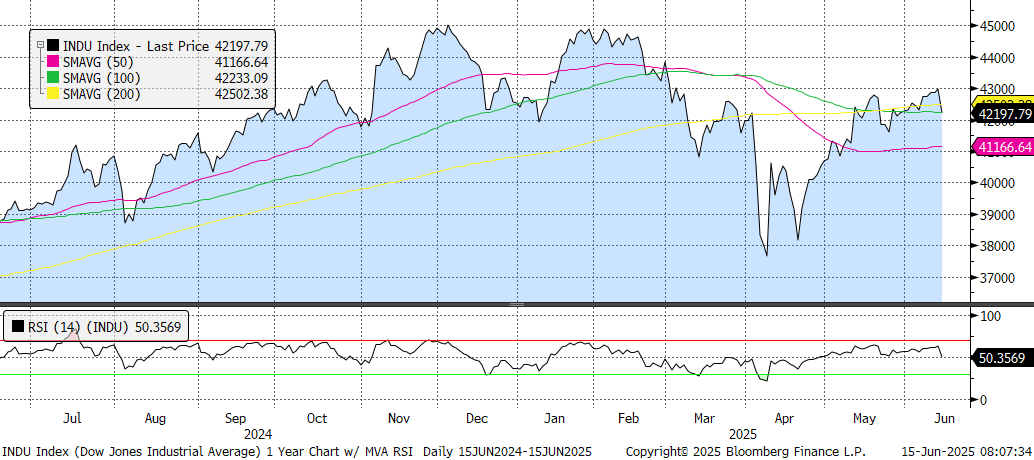

Moving Averages

S&P 500

Nasdaq

Dow Jones Industrial Average

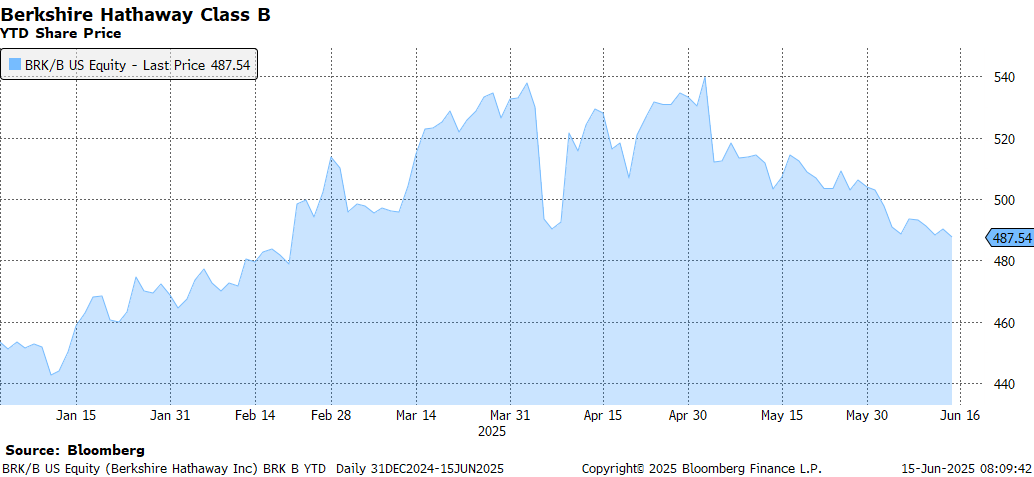

Berkshire Watch

(Charts as of 6/13/25)

A Look at the S&P 500 Sectors:

A look around the (multipolar) world:

Seasonality

Average Daily S&P 500 Index Returns over the Past 20 Years:

1-Year Trailing Chart of the VIX with RSI

Sentiment & Technical Indicators

Insider Buying & Selling

Top Buys in the Last 3 Months (as of 06/15/25 via Bloomberg)

Top Sells in the Last 3 Months (as of 06/15/25 via Bloomberg)

CNN Fear & Greed Indicator

That’s all for this edition - see you next month for more charts!

And later next week for a Special Field Notes Edition - HVP is on the road 6/18!

Notes:

We are pleased to share a monthly version of our internal Risk Dashboard with our clients and subscribers from the investing public at large. A few reminders:

The HVP Risk Dashboard is not an equity or credit research product and not a specific recommendation to make any investment decisions.

Data is generally presented here without comment.

HVP and affiliates may have positions in or against any securities referenced.

This is a chart heavy report. Clicking or tapping a chart will open it in a new window. While we all live on our phones, the best viewing will probably be on a larger screen such as your iPad, laptop, or desktop.

The Risk Dashboard is complimentary for HVP clients, institutional partners, and members of the investing public we hope decide to become clients!