Atlanta Braves Baseball - 2025 Investor Day

A Possible Double-Play - BATRA / BATRK

Yesterday, I had the opportunity to attend the investor day for Atlanta Braves Holdings (BATRA / BATRK), the parent company of the Atlanta Braves baseball team and associated real estate development The Battery on behalf of Hudson Value Partners. Coming from the Berkshire-Hathaway annual meeting in May, I reflected on the value of in-person research and diligence trips. While earlier in his career, different books recount examples of Mr. Buffett heading out to count rail cars and knocking on doors to speak with company management, today’s market has certainly changed.1 Regulation FD limits what management can say to one or a group of investors without full public disclosure or a form 8-K. The internet and live streams bring meetings to my desk every week. There is no shortage of alternative data like credit card activity to get a pulse for what is happening in the consumer economy between quarterly earnings reports. That said, I still believe there are instances in which an in-person visit remains a valuable addition to our research efforts.

With our investment in the Atlanta Braves, it is not just about the 162 regular season games and hopefully a strong post season showing, but also the long-term vision that they are delivering for the mixed-used real estate development around the stadium. While one can visit on their own, going to the investor day, I was able to walk the property with the people developing it and tour soon to open facilities. I had the chance to hear from all the key leaders and have follow up conversations with the President, CEO, and Chairman Terry McGuirk, the head of Braves Development Company (real estate) Mike Plant, and members of the investor relations, accounting, and legal teams.

MLB & Sports Investing Market

The sports investing landscape is very active. The Braves are among a handful of sports teams that are traded in public markets. In our 10 Surprises For 2025, we augured that this would be the year that sports became accepted as an asset class. As I was sitting in the event, news broke of a sale of the NBA’s LA Lakers2 and a potential sale of the troubled Tampa Bay Rays in the MLB.

One of the sessions was a discussion between Braves Holdings President Terry McGuirk and MLB Commissioner Rob Manfred. The talk outlined the “close” relationship between the Braves and MLB with Manfred describing the Braves as a “model franchise” from the MLB’s perspective and the team’s business mix as being the “envy” of other teams. League wide 70 million people went to ballparks in 2023 and 2024, with a similar pace expected for 2025. In the past 3 years the average age of a ticket buyer has decreased by 7 years. Last year in the World Series, three games had greater viewership in Japan & Korea than in the US & Canada combined.

The upcoming collective bargaining agreement (CBA) with the players and work to align the media rights into one league wide package for 2029 are key priorities and large opportunities for MLB. Baseball media rights are highly fragmented with some national broadcasts, some through MLB.tv streaming, and some regional sports networks (like the Yankees’ YES Network) which have varying degrees of reach, success, and profitability. While there are differences between the NBA and baseball, the comparison of the increasing value of their media rights and the benefit of selling the package collectively is clear: the NBA’s new media deal is worth $7.7 billion annually at the midpoint versus $2.7 billion in the prior deal. A single media package is likely more valuable than a 30 deal patchwork, especially in today’s media landscape with new players Amazon, Alphabet’s YouTube TV, Apple TV, and Netflix all fighting it out. The Braves were pioneers of national media for baseball, as when Ted Turner owned the team, many games were broadcast nationally on his TBS network, helping to build the Braves a national following.

Commissioner Manfred characterized Terry McGuirk as an “owner-leader” within baseball and the two speak most days. McGuirk is a key member of MLB’s “Committee on Economic Reform” representing Braves shareholders’ interests in improving the valuation of baseball teams against other sports teams. To me, this league wide effort to improve valuations represents a powerful catalyst – in some ways happening at the same level as the Tokyo Stock Exchange’s drive to improve corporate governance among Japanese stocks – the league and the exchange fill a similar rule making and agenda setting role for their members.

The national media strategy is at the heart of economic reform efforts and has the potential to create more central recurring revenue for the league and each team. That central revenue has the potential to eliminate the need for - or at least substantially rework - the revenue sharing agreements around the league which are viewed as a negative for team valuations. Similarly, some reforms around containing player compensation costs the way other leagues have are also a potential positive for valuations.

While the CBA looms large for the end of 2026, Manfred has been working to get ahead of it since the last round of negotiations by meeting with players from each team, each year (30 meetings per year), to talk about the current system where the top 10% of players earn 72% of the compensation. The league is also considering reforms to the free agent system, which is currently viewed as too long a period each year. While sports media may be negative on the prospects for a new CBA and the commissioner may be too positive (it is his job!) , I tend to think that money talks and a better deal for the 90% of the players earning 28% of the total compensation pool will win the day.

Baseball Operations

Getting to the Braves specifically, since their ownership in the Liberty Media era began, they have been one of the teams that has consistently gotten to the postseason, but done in it financially disciplined way. Alex Anthopoulos, GM of the Braves was particularly proud that MLB players rank the Braves as #3 behind the Yankees and Dodgers as the most desirable team to play for – even though they have a payroll roughly half of those teams. His overarching goal as GM is to make the team consistently competitive and avoid drama. Team President Derek Schiller was also quick to note that in the last ten years the team with the highest payroll only won the World Series in two years.

Off the field, management detailed the Braves’ improvements since they built the new Truist Field at the Battery. Since 2022, 90% of stadium capacity has been sold in tickets, as compared with the old stadium in 2015 and 2016 where only 50% of capacity was able to be sold. Baseball event revenue has grown at an 8% CAGR (tickets, concessions, ads, sponsors). The Braves are also notable for owning and operating the retail and concession business themselves, not contracting it out to a third party. This is a point that fits in well with the overall corporate ethos of the Braves Holdings as owner-operators of the team, the stadium, and surrounding real estate to create a “master-planned” fan experience. The Braves use AI to drive ticket pricing and to aid in security within the stadium. The average Braves ticket price is $54, with the lowest being $10. A recent HVP Read highlighted on our X page, Manage For Profit Not For Market Share, uses the Toronto Blue Jays as a case study for using dynamic pricing to fill a stadium and increase revenues through effective pricing.

The master planning of the team and real estate offers some compelling opportunities. The Braves’ relationship with Comcast is one example. Just steps from one of the stadium gates is the Comcast regional HQ building for 1,000 employees. Comcast is a sponsor with in-stadium brand areas and signage. Within the Battery development, Xfinity TV is in apartments, condos, restaurants, hotels, and offices, and additionally Comcast delivers Wi-Fi and internet to the whole area.

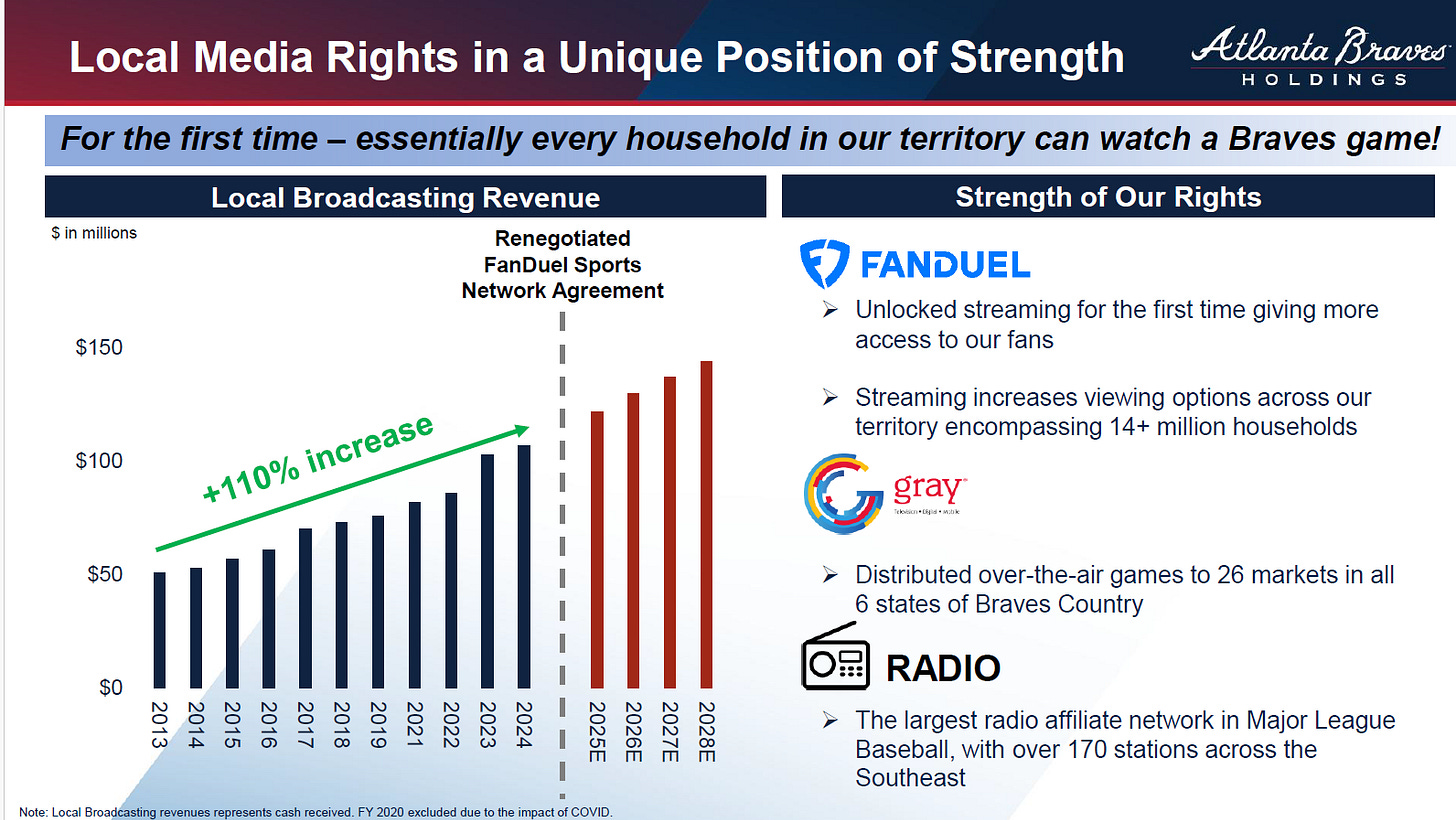

Recent changes within the regional media landscape allow every household within the territory to watch games. Streaming is available through FanDuel, and over-the-air goes to 26 markets in 6 states, radio broadcasts cover the southeast through 170 stations.

Among MLB, the Braves have been ranked #1 for overall guest experience, concessions and in-game experience.

Real Estate Operations

Braves Development Company (BDC) is responsible for the development and ongoing evolution of the Battery site, not just building the buildings, but also through the leasing, maintenance, and finding opportunities upgrade tenants. Across all properties, Atlanta Braves Holdings currently has a 98% occupancy level. I came away with an appreciation for the creativity of the BDC team in managing the physical site. The day started in the TKE Elevator Company tower, rising 27 floors above Cobb County and offering sweeping views of downtown Atlanta and mountain ranges in the distance. The building was as modern and impressive as anything you would see in a major financial center and given the marquee tenant being TKE, there were some spectacular (and fast) glass elevators. Other office tenants include Papa John’s Pizza corporate as well as Shake Shak corporate and a test kitchen.

The strength of the Braves brand and ties to the local business community were a key factor in the Battery being able to win the business for the new Truist Securities headquarters building which I was able to tour before its opening later this July. Originally Truist was perhaps looking for four floors in an existing building on the site, but that became too small for their needs. Through some creative engineering, BDC was able to take a site with steep grade directly across the street from a ballpark gate and put up a world-class 250,000 sq ft building financed by Truist Bank and leased entirely to Truist Securities.

So far this year, BDC has also acquired nearby office buildings in their “Pennant Park” acquisition.3 This brings additional parking for evening games and events under the Braves’ control and the 34-acre, 763,000 sq fit site has opportunities for expansion.

The Battery hosted 283 non-baseball events in 2024 and 74% of visitors were from outside of Cobb County, Georgia.

BDC contributes to the strength of the Braves baseball experience. The thoughtful creation and evolution of the live-work-play community of the Battery helps create additional cash flow for shareholders and over time has the potential to smooth out the seasonality of baseball revenues. I came away with the distinct sense that there is still more to come for future BDC real estate projects.

Concluding Thoughts

The MLB commissioner outlined a compelling plan to help improve the valuation of all baseball teams versus that of other major US leagues. The Atlanta Braves team made clear the benefits that the unified approach to baseball and real estate create to deliver a league leading fan experience and make the team a top choice for players. About 30% of the Atlanta population is 18-39 and the Battery is a favorite spot for young people to meet for concerts, baseball, dining, work, and even to rent apartments.

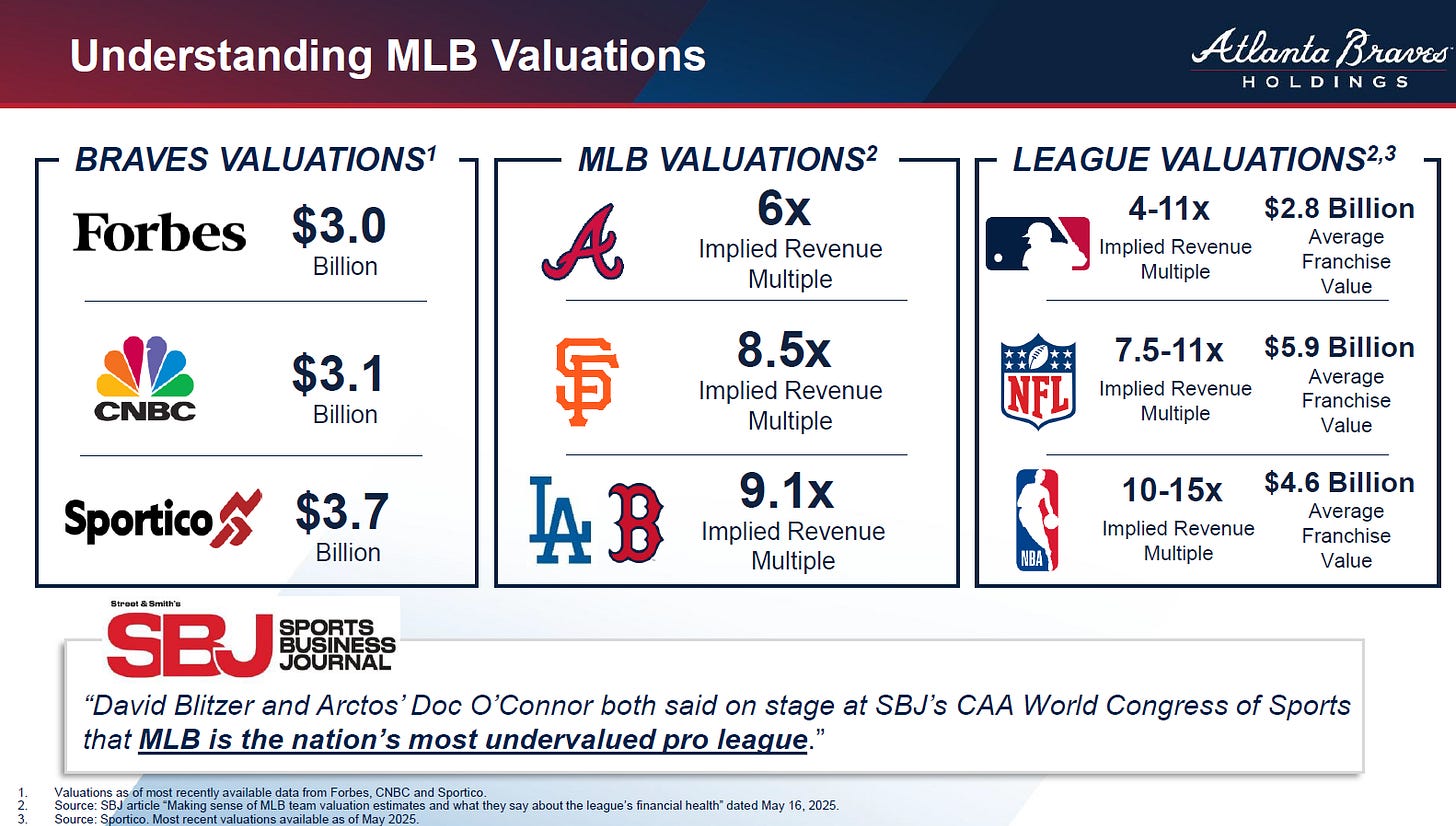

The valuation gap in public markets between what the Braves sell for today and what some teams with similar revenues (like the Red Sox) are valued at privately remain large. Greater investor engagement like yesterday’s event is a start. Notably the team needed MLB’s permission to be able to offer as much detail and a valuation framework on their real estate as they did for the first time yesterday. The current valuation discount reminds me of Berkshire-Hathaway (BRK.B) during COVID - when sitting down and doing the math, it seemed you were getting for “free” either the cash or the Apple (AAPL) stake. It was at that point that HVP decided to double our target position size for Berkshire-Hathaway, and we have been glad we did ever since.

With the Braves current valuation in public markets, the team is at the lower end of the scale for MLB despite very strong performance on the field, with fans, and as a top choice for players. Comparing that value to other teams suggests very little value is being given to the ongoing real estate development. How, when, and if that valuation gap ever gets closed remains an open question, but it is hard to think that the increased interest in sports investing will not help the valuation of this scarce asset and savvily operated team. If MLB can negotiate a smart CBA and improve the media rights package for the league, while Terry McGuirk and team continue to deliver a best-in-class fan experience, the odds of a “double-play” mean this is a game that we may want to stick around for the final innings of! - Christopher P. Davis

Note 1: We were pleased to see that the Braves chose Peter Millar as a merchandise partner for the golf shirts they gave to attendees. Peter Millar’s parent company, Richemont (CFRUY) is also an HVP portfolio company.

Note 2: The source for much of the material discussed in this note can be found in the full Braves 2025 Investor Day presentation on their website: https://www.bravesholdings.com/investors/news-events/presentations

Note 3: HVP is a holder of shares of the Atlanta Braves BATRA/K for separately managed accounts and the limited partnership we advise. Not all accounts hold all positions depending on individual client suitability and approach.

Brett Gardner’s Buffett's Early Investments (2024) and Yefei Lu's 20 Cases: Inside the Investments of Warren Buffett (2016) are two good books on this topic.

https://www.cnbc.com/2025/06/18/lakers-owners-buss-family-sell-majority-stake-valuation.html

https://www.bravesholdings.com/news/press-releases/detail/205/atlanta-braves-holdings-acquires-six-building-pennant