October 2025 - Fundamentals (Still) Matter

Markets made it through the spooky season

We wrote in August that we thought it would be a headline driven fall and that turned out to be a safe bet. In some ways the headlines though are “recycled” - more back and forth with China, Ukraine, the Mideast, the Fed, and questions of whether AI dominated markets are in a bubble. In geopolitics some progress appears to have been made, but in markets many of the same questions remain. We’ll share 5 Takes with the benefit of the HVP having listened to dozens of Q3 2025 earnings calls so far this reporting season:

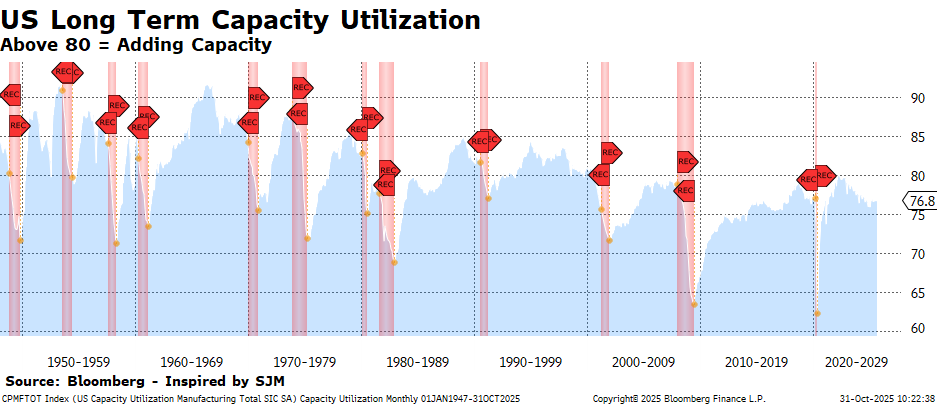

Tariffs - industrial companies are commenting that they don’t see tariffs (as implemented) being a headwind to margins in 2026, having offset them partly through price increases, changes to sourcing, and partly through other cost cuts.

AI Capex - the market is treating those who have the Free Cash Flow and enterprise customers to back up their spending different than those who are more in the consumer side and/or using debt to finance the investments.

Volatility - we have the feeling so far that earnings misses are being punished more severely than usual by the market, but until earnings season concludes it is more difficult to quantify. That makes sense to us given that meets to small beats are getting muted reactions as well. Consensus expectations appear to have been cut too much in the face of tariff uncertainty earlier this year.

Speculative Fervor - a Bloomberg analysis of factor returns in Q3 showed that the “junk” - those stocks that aren’t categorized as high quality, profitable, or with lower price to earnings - floated to the top. That gives us the sense that there is still a degree of underinvestment out there and cash that people are willing to chase with.

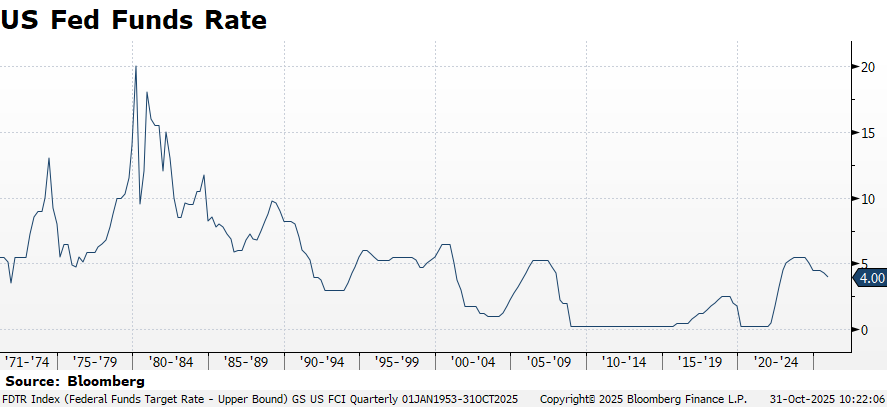

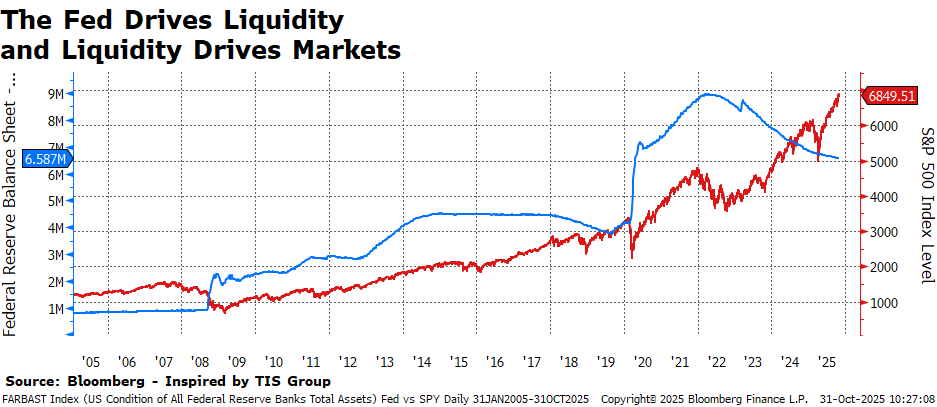

The Fed - we reiterate our longstanding view that Central Bank press conferences are not helpful to markets. Let interest rates be set by the market, observed by participants, and less of a spectator sport. For those weighing capital allocation decisions in the real economy, interest rates are but one input in deciding whether or not a project goes forward.

In the press, our Christopher Davis shared his thoughts with Bloomberg News in their report on the end of an era - next year’s Berkshire annual letter will not be written by Warren Buffett (full article link here)

The annual letter, a must-read for his devoted base across the world, gave readers investing advice, nuggets of wisdom and witticisms that helped build Buffett’s folksy, down-to-earth reputation despite his fortune.

“Getting the annual Buffett letter each year was Christmas morning for me as an investor,” Christopher Davis of Hudson Value Partners told Bloomberg. “It will be an evolution of the Berkshire shareholder experience to hear from Mr. Abel in the letter and on stage in Omaha.”

And to kick off the week, Christopher joined BNN Bloomberg live from our Palm Beach office to offer a tech sector earnings preview, and quick updates on Qualcomm (QCOM), Franco Nevada (FNV), and Thermo Fisher Scientific (TMO). You can catch the clip on YouTube below:

Themes to Takeaway

Bullish Themes

Interest rates are declining - non recessionary rate cuts may be bullish for equities

Tariffs are being handled better by firms than most feared

There’s a strong cup of US economic stimulus coffee brewing for 2026 - tax cuts, tax refunds, spending & investment deals are all on deck

Bearish Themes

Housing affordability is still challenged

There are pockets of speculative excess in stocks

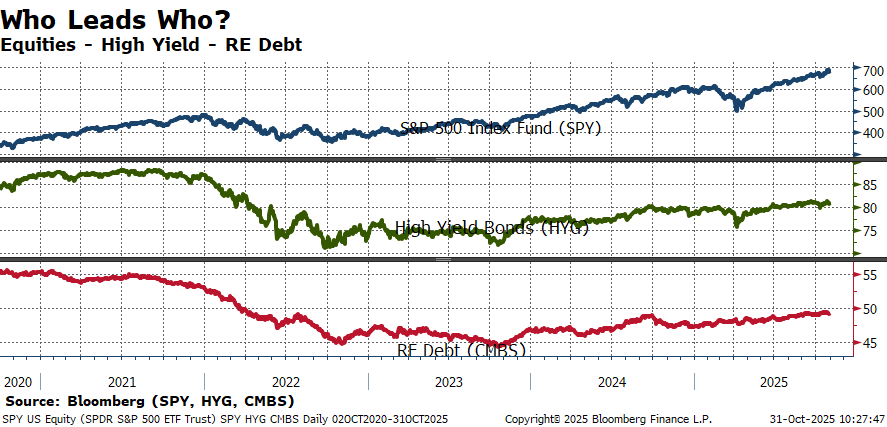

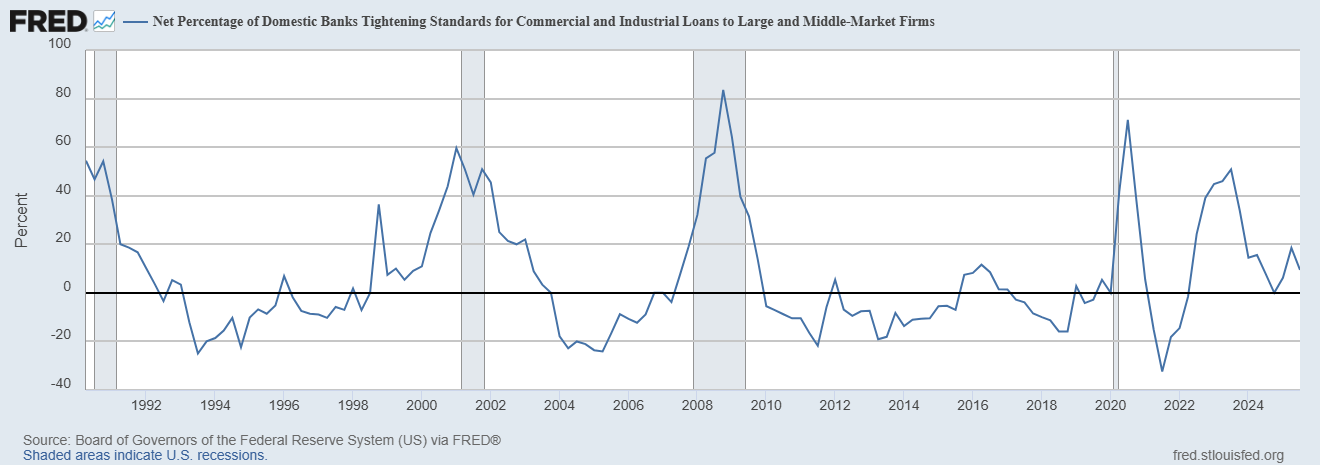

Cracks and risks are emerging in the lending markets

Keep your eye on

When the government shutdown impasse gets resolved in the US

The Supreme Court IEPA case on Tariffs - oral arguments begin next week

Whether the “unicorn” tech start ups can actually pay for their announced cloud & AI investment deals with the biggest names in tech

Whatever happened to?

Worrying about counterparty risk?

If you haven’t already….

Lies, Damn Lies, and Economic Statistics

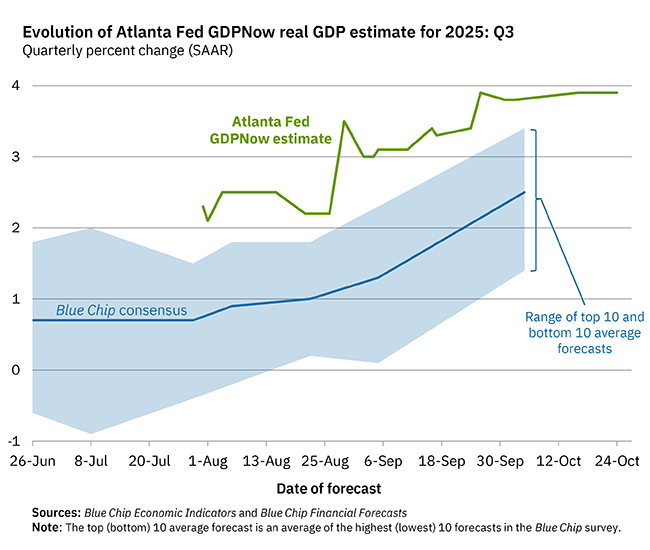

Atlanta Fed GDPNOW

Y= C + I + G + Xn

October 27, 2025 Estimate: +3.9% for Q3

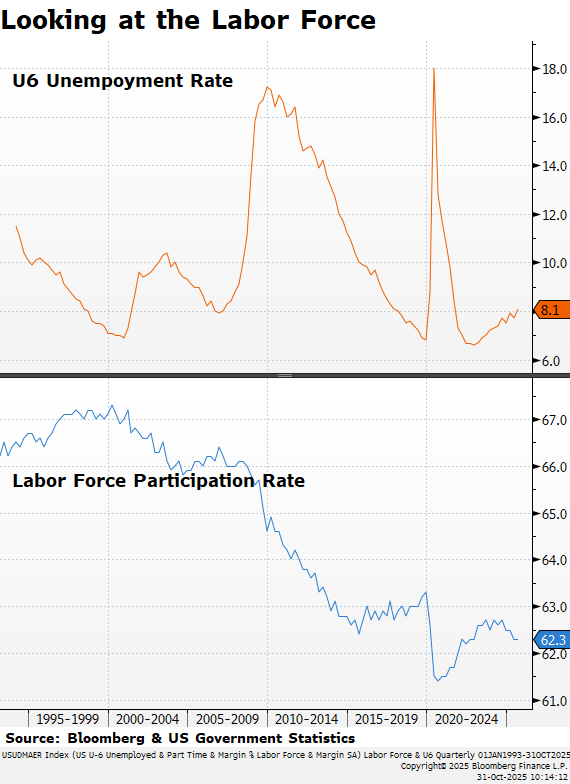

U6 Unemployment calculated in the pre-1994 adjustment method:

28.00%

(John Williams’ Shadow Government Statistics August 2025)

Tech Sector Layoffs:

2025: 112,732 employees /218 companies

2024: 152,074 employees/546 companies

2023: 263,180 employees/1,191 companies

2022: 166,269 employees/1,064 companies

Federal Sector Departures & “DOGE” Cuts:

Total YTD Federal Departures: 182,528

…of which DOGE Layoffs are: 71,891

(layoffs.fyi as of 10/31/2025)

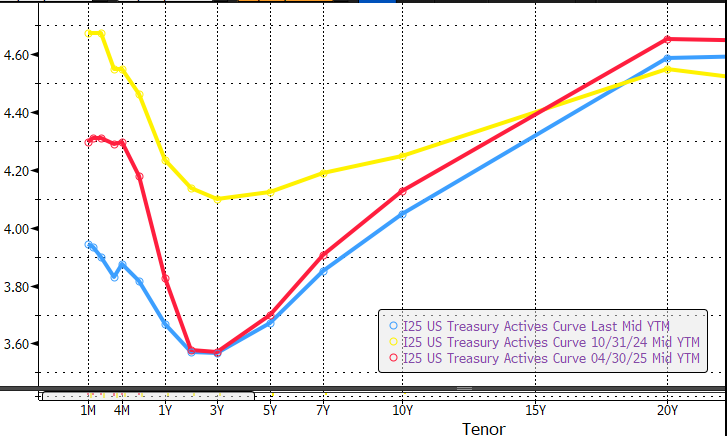

The Movement of the US Treasury Yield Curve

Blue = Current; Red = 6 months ago; Yellow =1 Year Ago

Net % of Banks Tightening Lending Standards for C&I Loans

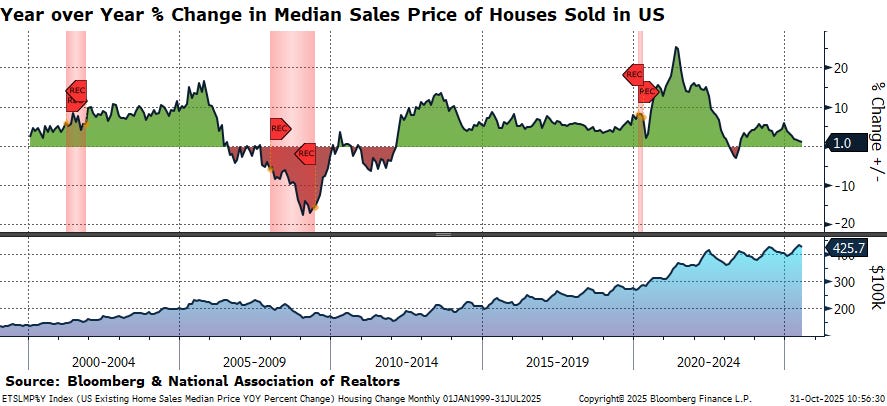

Looking at Housing

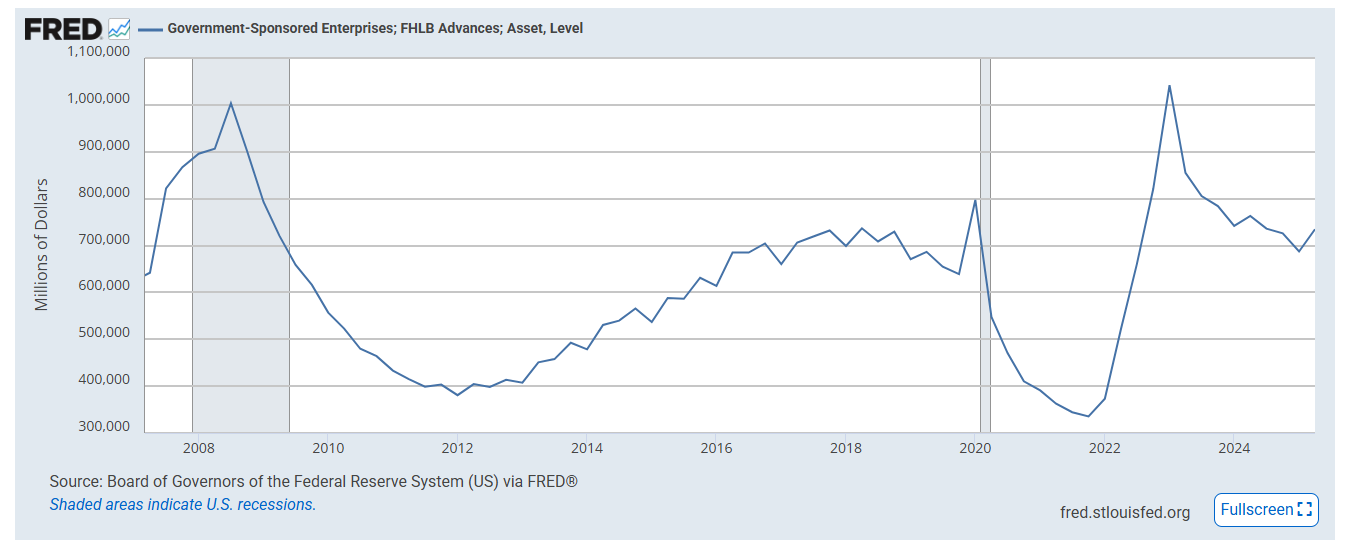

Canary in the Coal Mine: FHLB Borrowings

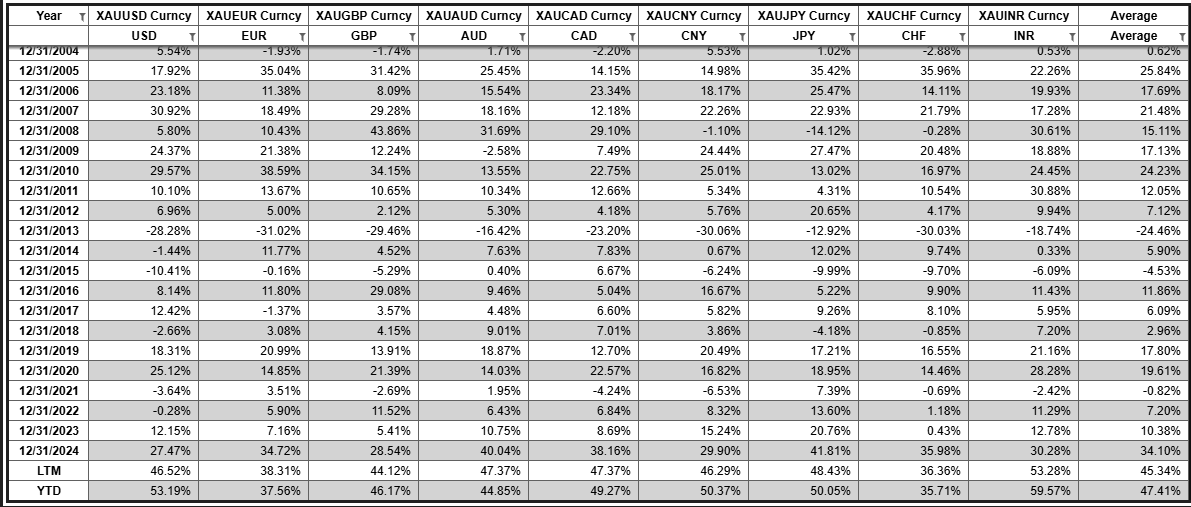

Performance of Gold in Major Currencies - % Change

Broad Market Levels

Top Panel/Blue = SPY; Middle Panel/Green = HYG; Bottom Panel/Red = CMBS. As of 10/31/2025.

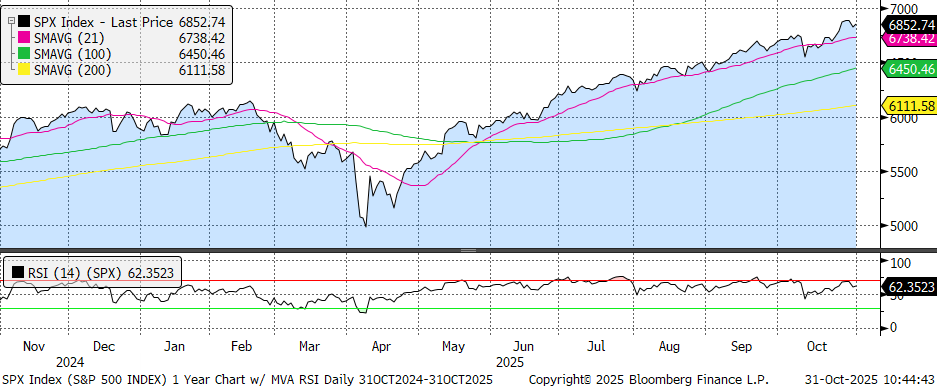

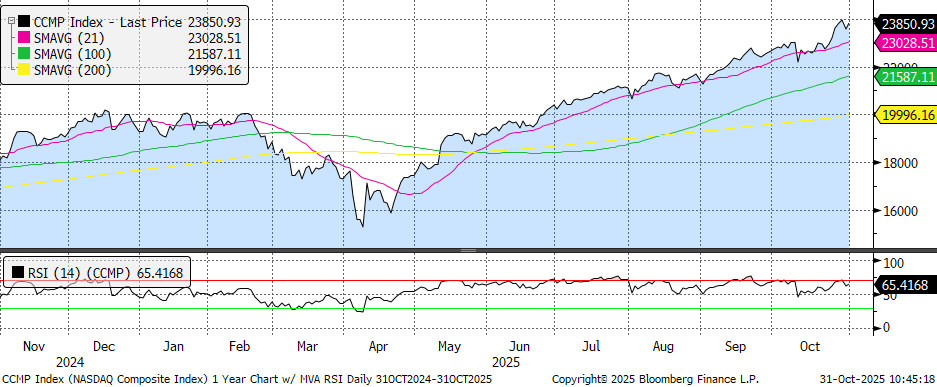

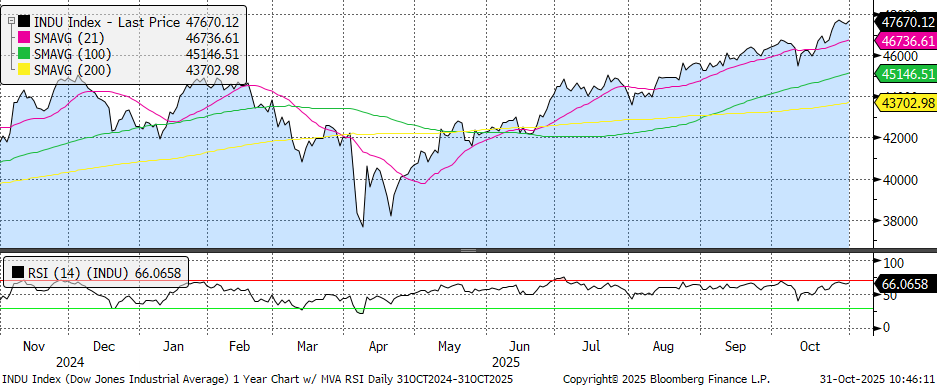

Moving Averages

S&P 500

Nasdaq

Dow Jones Industrial Average

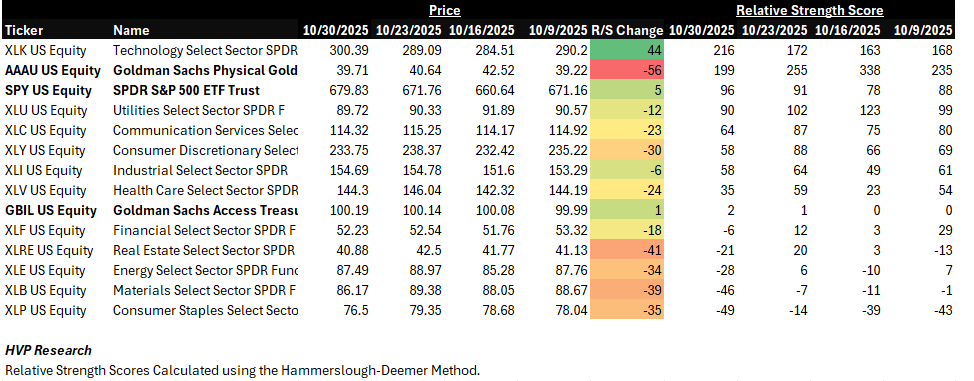

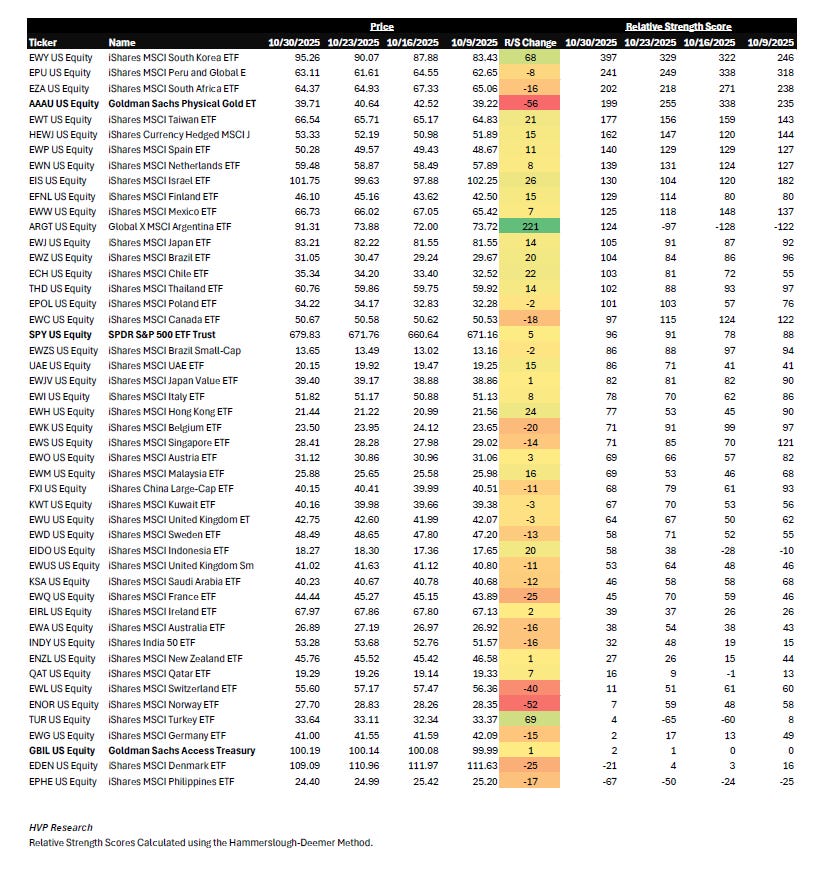

A Look at the S&P 500 Sectors:

A look around the (multipolar) world:

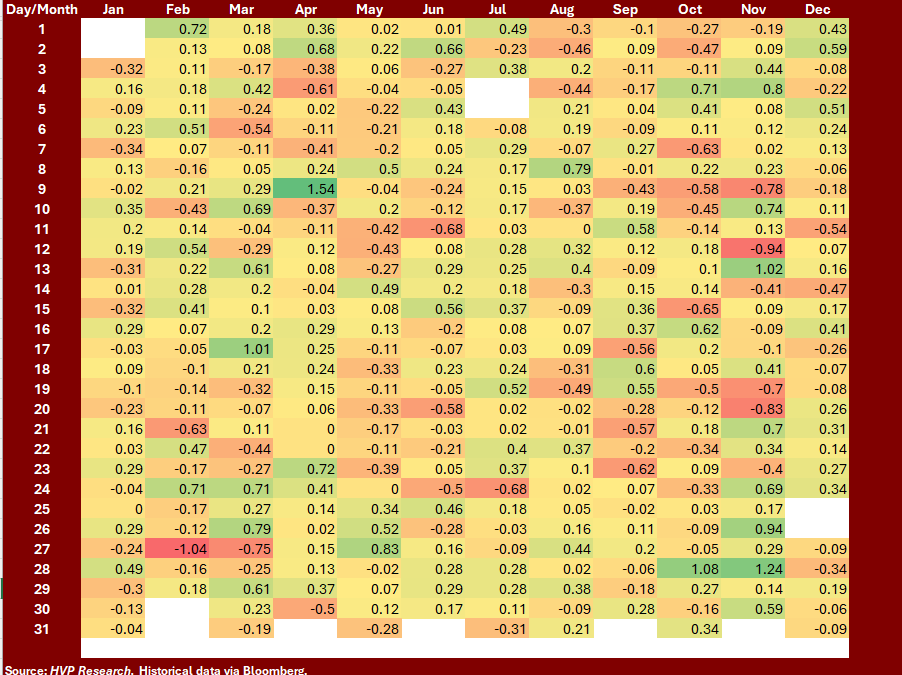

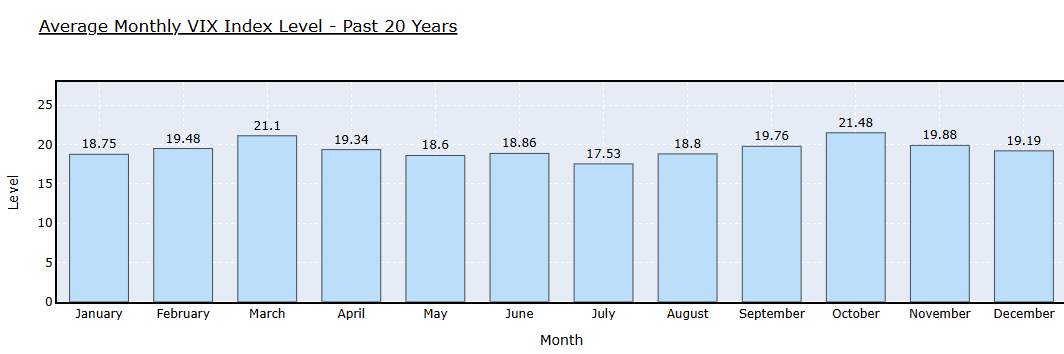

Seasonality

Average Daily S&P 500 Index Returns over the Past 20 Years:

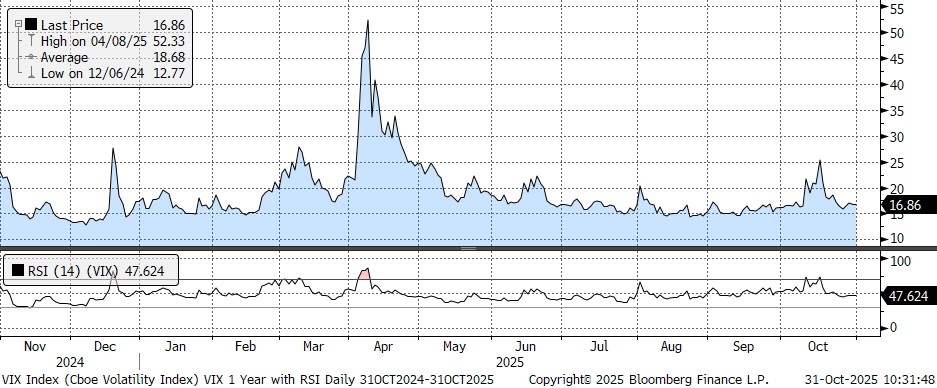

1-Year Trailing Chart of the VIX with RSI

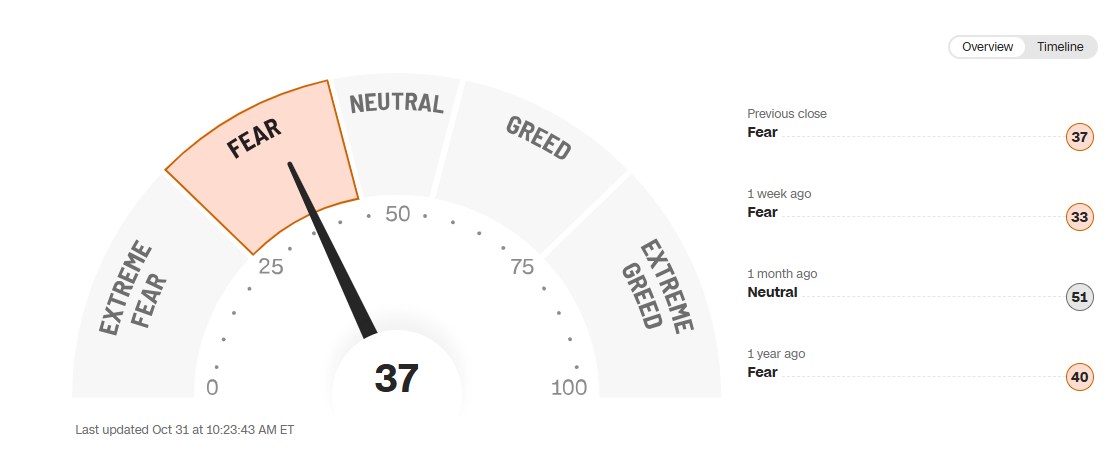

Sentiment & Technical Indicators

Insider Buying & Selling

Top Buys in the Last 3 Months (as of 10/31/25 via Bloomberg)

Top Sells in the Last 3 Months (as of 10/31/25 via Bloomberg)

CNN Fear & Greed Indicator

That’s all for this edition - see you next month for more charts!

Audio companion still in the works!

Notes:

We are pleased to share a monthly version of our internal Risk Dashboard with our clients and subscribers from the investing public at large. A few reminders:

The HVP Risk Dashboard is not an equity or credit research product and not a specific recommendation to make any investment decisions.

Data is generally presented here without comment.

HVP and affiliates may have positions in or against any securities referenced.

This is a chart heavy report. Clicking or tapping a chart will open it in a new window. While we all live on our phones, the best viewing will probably be on a larger screen such as your iPad, laptop, or desktop.

The Risk Dashboard is complimentary for HVP clients, institutional partners, and members of the investing public we hope decide to become clients!