October 2024

The home stretch...

“When your work speaks for itself, don’t interrupt.”

- Henry J. Kaiser

There are probably only a handful of times in the collective careers of the HVP team where all the data gave us “green lights” - and even when everything points to one thing that can be an uncomfortable place too as things can’t improve from there. In this month’s HVP Risk Dashboard, we find ourselves trying to make sense out of dissonance and to parse the short term noise from long term trends.

As investors, our views get expressed through the stocks we own for our clients. Stocks are leading indicators and much of the economic data we get is backward looking or at best, a coincident indicator. As earnings season picks up, we think it will be a “something for everyone” type of quarter - able to create a bullish or bearish narrative depending on your slant. Looking at the price action in markets starting this week (week of 10/21/24) it has begun to feel like we are in the pre-election washing machine - with the markets on the “agitate” setting. We touched on this in our Q3/Autumn investor letters, but we think this earnings season in particular it is most important not to overreact to any stock price moves as the marginal trader (or even punter!) is trying to game it all through the lens of a US presidential election that’s on a knife edge. We are lucky that our investment horizon extends beyond any one presidential or congressional cycle and that great companies find ways to grow stronger no matter the political leadership.

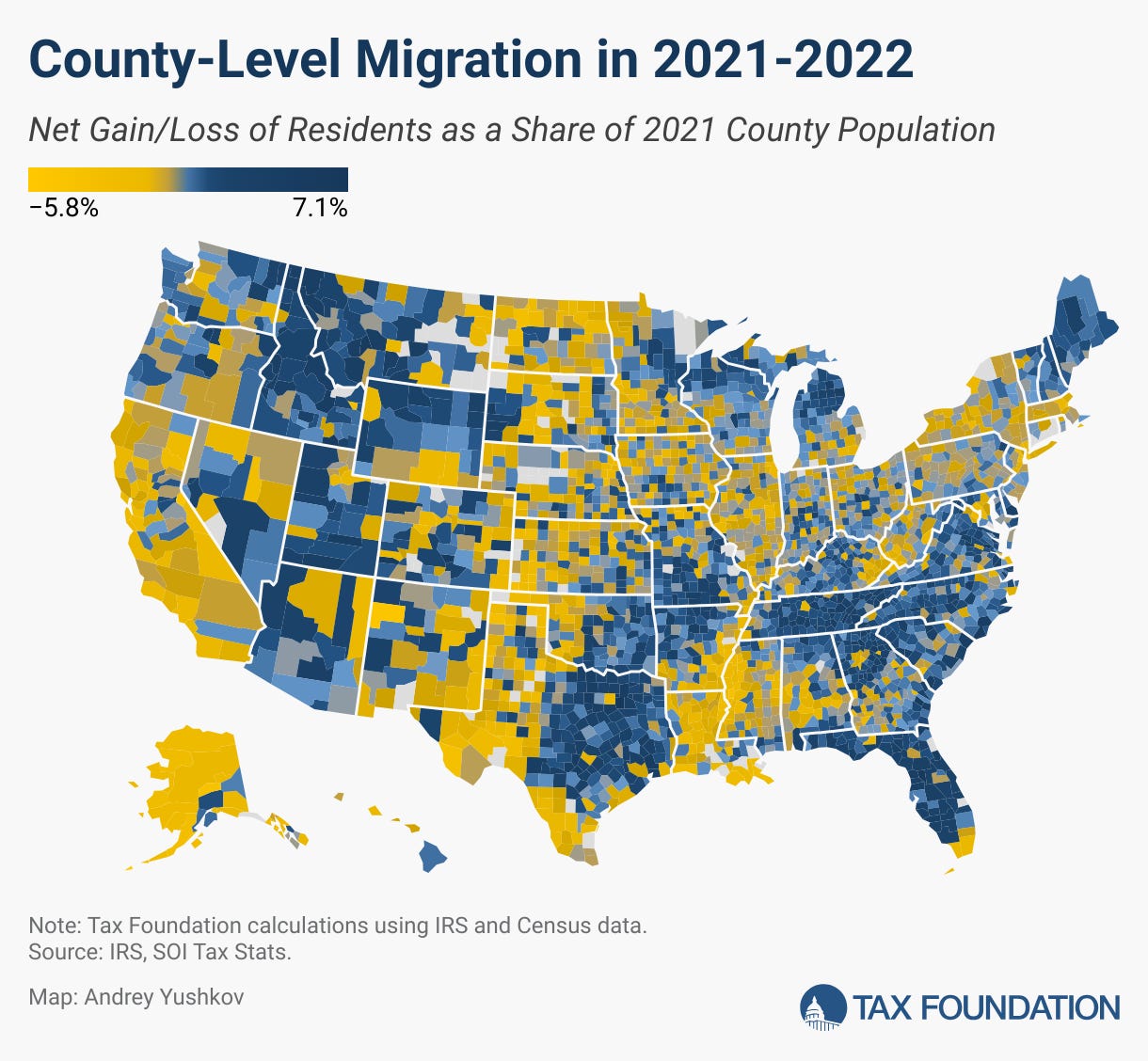

That said, the U.S. has certainly changed since the 2020 election. We always like to look at big picture trends and the map below from the Tax Foundation is the most recent we could find showing how the population has moved in the years since then:

Blue counties have gained in population and yellow counties have lost population. People talk about migration to the sun-belt and lower tax states, but it is interesting to consider also that there has been migration within those states and the people who move sometimes bring the political leanings of their home state with them.

Turning back to stocks, our intention is to listen to as many earnings calls as we can and weigh those mosaic pieces more heavily than any short term price movements in the coming weeks.

Bullish Themes

GDP Now and other macro productivity indicators are strong

Margins appear to be holding up at the company level

Fiscal spending looks set to continue in the US and globally no matter election outcomes

Bearish Themes

The strength of gold is telling us something very different than reported inflation statistics

Markets will one day start caring about national debts

After a short lived pop in March of 2024, ISM Manufacturing measures have spent most of the past 2 years under 50 - meaning “in contraction” (chart below)

Keep your eye on

India

BRICs meetings and currency rumblings

If a geopolitical risk premium starts to show up in commodity markets - especially oil

Anti-trust & monopoly lawsuit announcements vs. announced M&A activity

Whatever happened to?

All the ways 5G was going to change our lives?

We’re excited for the November HVP Risk Dashboard as the world might just be able to focus on company level results again by the time we put the report together. We also are working on a special December edition which will look to 2025 in creative ways.

If you haven’t already….