March 2025

Spring & Change in the Air

The subtitle of last month’s Risk Dashboard - “There will be bumps” – proved to be well timed as about 2 days prior, markets made what has since been a top for 2025. The round number of a 10% decline from the highs is considered a “correction” which although not an uncommon occurrence, is rarely pleasant. We believe that the growth of passive, price-insensitive investing (buying every stock / selling every stock all at once) to more than half the market, coupled with the rise of algorithmic trading and highly levered risk control strategies, make faster drops - as we experienced - likely to be a recurring feature of the market.

Markets were swept up by optimism after the election. In 2017, many of the pro-business policies such as deregulation and tax cuts came before the attempts to recalibrate relationships with America’s trade partners through tariffs. This time the vinegar came before the honey and markets didn’t quite expect it.

In our January note we had Treasury Secretary Scott Bessent in our “Keep an Eye on” list – his performances so far in the press have been strong and it is notable the degree to which he is traveling the world on behalf of the administration. Surprising investors who were used to the first Trump administration using the stock market as a barometer of success, Bessent has been unmoved by price-action and focusing on the fiscal house. For all the attempts to paint the president as focused on the billionaire class, policy actions have been decidedly populist and Main Street oriented.

In the past few years, diversification across industries, company size, and geographies was not as rewarded as had been in the past – earning it the sobriquet diworsfication ! But in 2025 it has paid off so far.

Stocks can handle a few unknowns and variables being in play – perhaps up to 3. But when those question marks approach a half dozen – Tariffs? Trade war? Gaza? Ukraine? Deportations/Labor Force? Cuts to Spending? – it becomes much tougher for market participants to price. As such, our outlook remains choppy, but constructive so long as some of these variables begin to be resolved.

10 Surprises Check-in

#7 China being a political focus but investors looking at India more… China is certainly in geopolitical focus, and Chinese stocks have trounced their India counterparts so far this year. While there are still 3 quarters to go, this one is looking like a swing and miss on the investment front. A good reminder that sometimes simply being so cheap can still be enough of a catalyst!

As for sports becoming more of an asset class, all we can say is…play ball:

Themes to Takeaway

Bullish Themes

Economic indicators, while slowing, are still positive.

Germany’s radical mindset shift may portend long term fiscal growth stimulating the continent.

Innovation hasn’t stopped in technology, healthcare, or applications of new ideas

Bearish Themes

Sentiment indicators have weakened, even more so along political party lines.

Uncertainty will lead to lower earnings forecasts from many firms and downward revisions.

The indexes are still top-heavy and cheaper pockets don’t matter as much to the aggregate.

Keep your eye on

The 10 Year Treasury yield which has clearly become the focus point for the administration - 30 year mortgage rates tend to be correlated to the 10 year over the long term and a lower 10 year improves the ability to refinance the US debt.

Any clarity that may emerge from the much anticipated April 2nd tariff announcement from the White House.

Whatever happened to?

“I don’t think we should ever shake hands again” - a public health official 5 years ago in the pandemic.

If you haven’t already….

Lies, Damn Lies, and Economic Statistics

Atlanta Fed GDPNOW!

Y= C + I + G + Xn

March 18, 2025 Estimate: -1.8%

*Note: there are some distortions from large scale gold imports during Q1 as well as import pull-forwards due to tariff concerns that create noise in the Net Exports (Xn) component. For example, Bloomberg’s competing GDP Nowcast takes into account some of these factors and comes to a positive +1.79% (as of 3/24/25).

Alternative Looks at the Labor Force:

U6 Unemployment calculated in the pre-1994 adjustment method:

27.40%

(John Williams’ Shadow Government Statistics February 2025)

Tech Sector Layoffs:

2025: 23,382 employees /89 companies

2024: 152,074 employees/546 companies

2023: 263,180 employees/1,191 companies

2022: 166,269 employees/1,064 companies

Federal Sector Departures & “DOGE” Cuts:

Total YTD Federal Departures: 116,033

…of which DOGE Layoffs are: 38,791

(layoffs.fyi as of 3/24/2025)

Global Central Bank Postures

The Movement of the US Treasury Yield Curve

Blue = Current; Red = 6 months ago; Yellow =1 Year Ago

Net % of Banks Tightening Lending Standards for C&I Loans

Looking at Housing

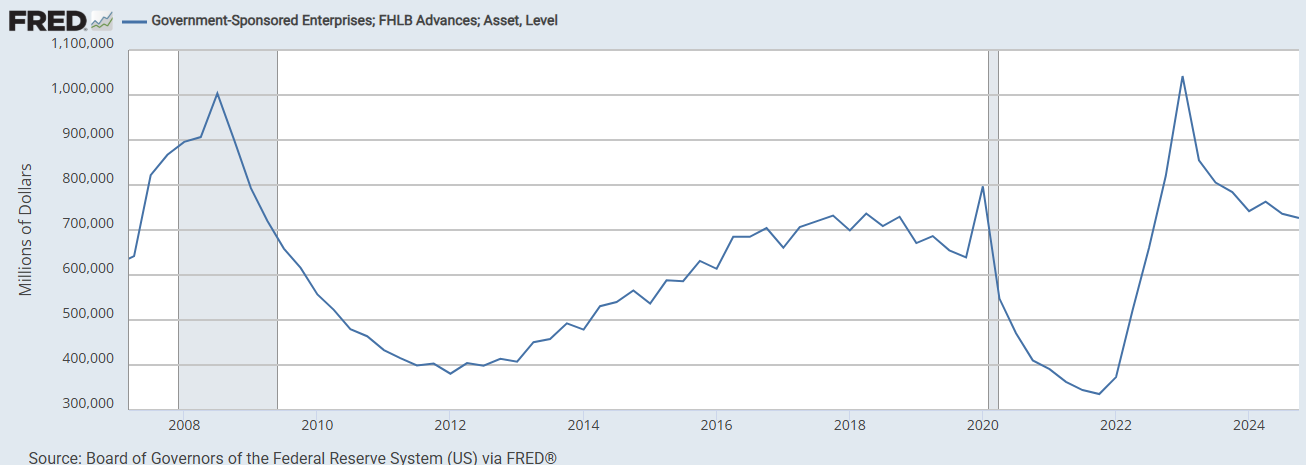

Canary in the Coal Mine: FHLB Borrowings

Performance of Gold in Major Currencies - % Change

Broad Market Levels

Top Panel/Blue = SPY; Middle Panel/Green = HYG; Bottom Panel/Red = CMBS. As of 3/25/2025.

Moving Averages

S&P 500

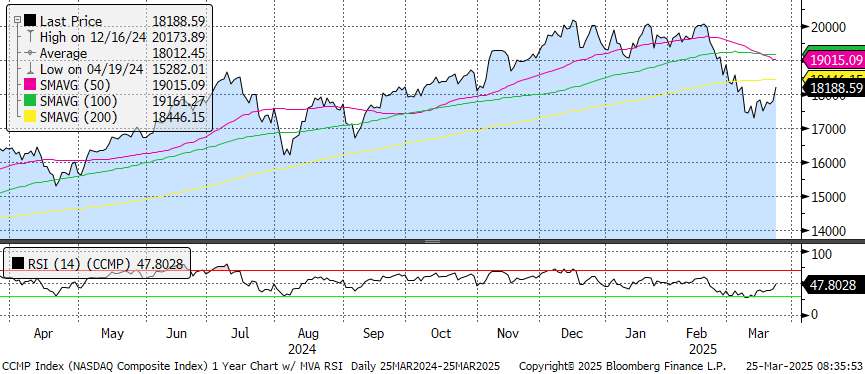

Nasdaq

Dow Jones Industrial Average

Berkshire Watch

(Charts as of 3/25/25)

A Look at the S&P 500 Sectors:

A look around the world:

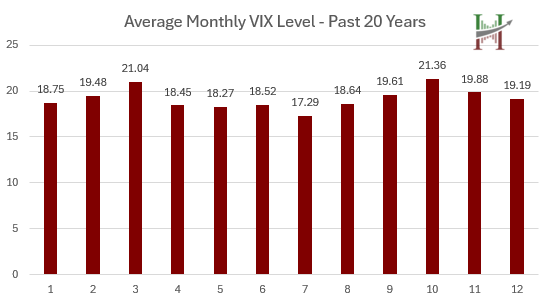

Seasonality

Average Daily S&P 500 Index Returns over the Past 20 Years:

1-Year Trailing Chart of the VIX with RSI

Sentiment & Technical Indicators

Insider Buying & Selling

Top Buys in the Last 3 Months (as of 03/24/25 via Bloomberg)

Top Sells in the Last 3 Months (as of 03/24/25 via Bloomberg)

CNN Fear & Greed Indicator

That’s all for this edition - see you next month!

Notes:

We are pleased to share a monthly version of our internal Risk Dashboard with our clients and subscribers from the investing public at large. A few reminders:

The HVP Risk Dashboard is not an equity or credit research product and not a specific recommendation to make any investment decisions.

Data is generally presented here without comment.

HVP and affiliates may have positions in or against any securities referenced.

This is a chart heavy report. Clicking or tapping a chart will open it in a new window. While we all live on our phones, the best viewing will probably be on a larger screen such as your iPad, laptop, or desktop.

The Risk Dashboard is complimentary for HVP clients and institutional partners. Members of the investing public can subscribe for a low monthly fee.