February 2025

There will be bumps.

It’s been an interesting February so far - and there are 8 days left! One pattern that sticks out is in November (post election) smaller, cyclical, and less expensive stocks moved sharply higher. That move reversed in December. It flipped back again in January, being a very strong month, and now some of the air has come out (again) in February. It is hard to tell what has truly changed during any of those periods though. It is a bit reminiscent of odd/even watering restrictions for your lawn during a drought! Mark your calendars accordingly.

More than halfway through Q4 earnings season, Bloomberg aggregate data shows sales growth at about 4.61% (vs 4.63% last quarter) and earnings growth at a solid 8.88% (vs 5.4% last quarter) with 1639/3095 companies in the data set reporting. (As of 2/20/25).

As we have cautioned in prior HVP Risk Dashboards, it is important to pay attention to implemented policies versus those simply talked about. The 48hr US/Mexico/Canada trade war is a good example. Little has been implemented - for now.

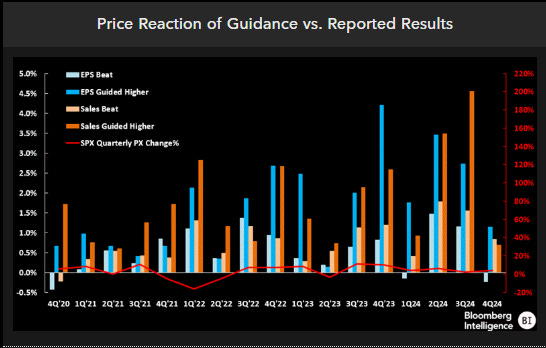

While aggregate numbers have so far been strong in earnings season, it hasn’t been necessarily as satisfying as an investor to watch. This excellent Bloomberg Intelligence chart details the rather muted reactions stocks are having to good news this quarter - the smallest since 2Q of 2023 (click image to enlarge).

In HVP news we were delighted to catch up with investing friends at the 28th Annual CSIMA conference at Columbia University on 2/7 in NYC. Our Christopher P. Davis spoke on a panel and shared why we started HVP, our process, and one recent stock pick.

On the same trip, Christopher stopped by the NYSE to make the case for 3 recent purchases as well. You can view the clip below.

10 Surprises Check-in

#1 about DOGE having a national impact - it very much seems so - and not just in media palpitations.

#2 about investors reassessing NVDA market share expectations due to challengers in AI chips. 1/2 way there - it wasn’t a chip challenger, but a cheaper model from DeepSeek.

Themes to Takeaway

Bullish Themes

GDP Now and other macro productivity indicators are strong.

Earnings reports have been solid.

Tariffs have been more bark than bite.

Bearish Themes

The broad stock market in the US is expensive on a historical basis.

The

MagnificentIncumbent 7, have been weak this year.Inflationary measures may be ticking back up.

Keep your eye on

European politics as they continue to unravel; the leadership vacuum north of the border in Canada.

Layoffs - not just from DOGE, but major corporations as well. Efficiency may become a movement.

Changes in healthcare and food regulation.

Whatever happened to?

All those people who got into the Airbnb and short term rental game in the ZIRP/COVID era?

If you haven’t already….